Bank Fees

Overview

Banks love their fees, and they make a lot of money from them. However, a bank fee audit can identify how much of your cash flow is consumed by these fees. At TruPowur, we can conduct an audit on your accounts to help you save money on bank fees and improve your cash flow.

After receiving an initial bank fee analysis for each bank relationship from the organization, we communicated with the bank representatives to obtain additional data.

In addition to the application of proprietary knowledge and methods, the following bullet points outline some of the steps performed throughout the detailed audit process:

Thorough review of routine bank maintenance fees, including cash orders, deposit tickets, bag processing, lock box arrangements, wire transfers, ACH transfers, pickup and delivery fees, back credit, and more.

Complete analysis of service levels, as well as asset allocation to identify potential for a lower cash-carrying cost.

Identification of unused accounts and services.

Potential opportunities for aggregation of services to reduce overall costs.

TruPowur Auditing Services You Can Trust

Our Process

Consult

Access 16+ cost-saving solutions spanning 4 subcategories (Utility Services, Contract Services, Financial Services, and HR Services). There is often one, or more, areas in which we can aid our clients.

Audit

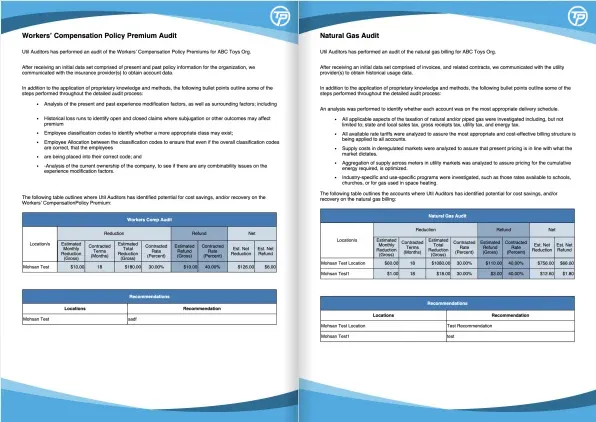

Our Auditors deploys proprietary knowledge, methods, and superior technology to thoroughly analyze invoices and services for errors, anomalies, and inefficiency in billing. Clients can login to track the progress of each audit, at each location, in “real time” using the Client Portal.

Advise

An interim report of findings can be downloaded at any time during the audit process through your uView Dashbard. A formal report of our audit recommendations is provided by our Auditors on every audit project.

Deliver

Where some audit firms simply make recommendations, Our Auditors will assist you to implement the cost savings and obtain the refunds that we identify. We will act as your project lead, completing paperwork and compiling claim documents for your review that are required to realize the benefit of what we propose.

Achieve

As a contingency-based service we only invoice for cost savings and refunds if, and after, the client realizes them.

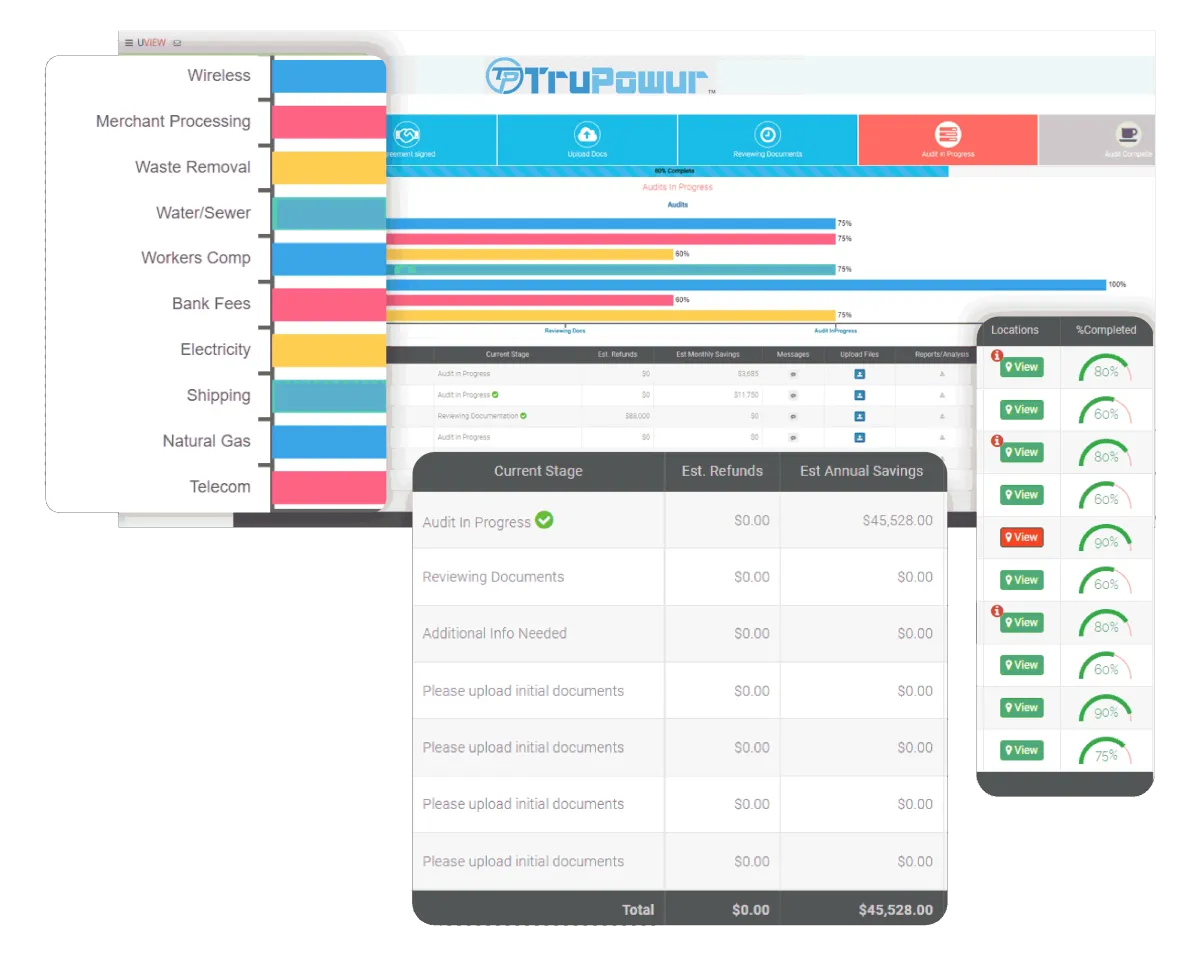

Views360™ is a holistic dashboard where clients track the progress of each audit, at each location, in real time.

Whether you’re managing a single manufacturing site or a nationwide retailer with thousands of locations, Views360 simplifies your cost containment projects. With multi-audit visibility, real-time communication, and dynamic savings reports, everything you need is just a click away!

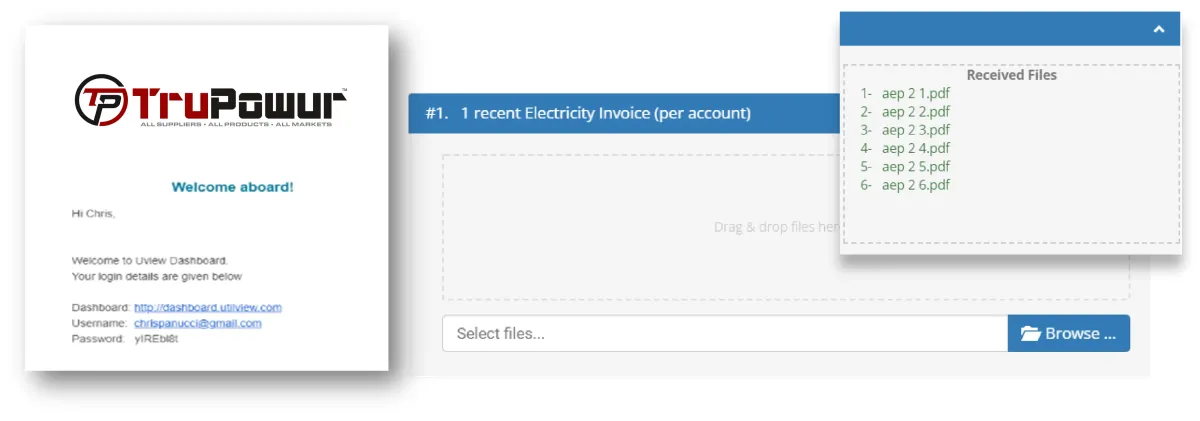

Step 1: Data Upload & LOAs

The process starts with a simple data upload request needed to complete the cost reduction project. Any necessary Letters of Authorization will be available for download/upload within your dashboard or emailed to you.

Step 2: Analysis Begins

Our cost reduction experts will begin identifying errors and inefficiencies within your billing structures. The option to communicate with the auditor assigned to your audit is available within your Views360™ dashboard. You will receive notifications when savings are found and ready to implement.

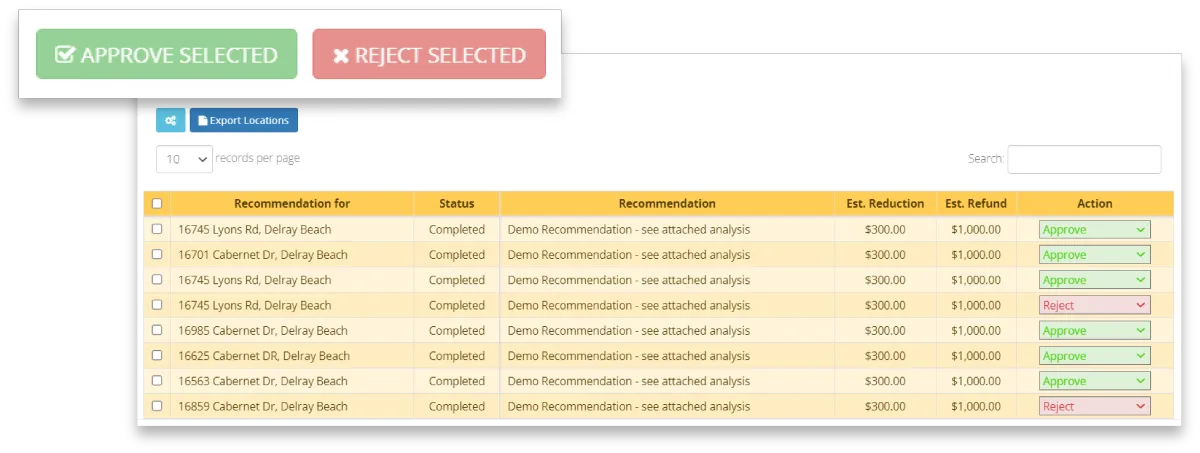

Step 3: Implementation of Identified Savings

View, approve, or deny all cost savings recommendations within the client portal. You will receive an email notification once results are ready for your review. All savings recommendations are approved by the client prior to implementation.

Step 4: Savings & Audit Report

Sit back and enjoy savings! You will receive a complete audit report of the savings and refunds implemented, as well as the ability to track ongoing savings and invoices, all within your client portal.

We’ve Created A Friendly Guide About All of Our Audit Services To Help You Take Control Of Your Finances Once And For All

We take a holistic approach to every engagement, thoroughly reviewing multiple service areas to enhance operational efficiency. Leveraging a global network of specialized expertise across various cost categories, we assign an experienced cost containment specialist to each project.

Copyright © 2007-2026 TruPowur, Inc. | All rights reserved.

All Suppliers • All Products • All Markets

Privacy Policy | Terms of Service

Copyright © 2007-2026 TruPowur, Inc.

All rights reserved